This version of terms applies to new customers who join from 2nd September 2020. Customers who joined before 2nd August 2020 should refer to the previous terms as these will still apply to their account until 2nd September 2020. These terms apply to all customers that fall under our Corporate category and receive services from FreemarketFX Ltd.

Please click here to see the previous terms that apply until 2nd September 2020.

1. The Site, the Service and our agreement with you

1.1. Please read these terms and conditions of use (“Customer Terms and Conditions”) and our “privacy policy” as they apply to your use of this website, the services we provide and content you find here.

1.2. These Client Terms and Conditions are between FreemarketFX Limited, a Private limited company incorporated in England and Wales with company number 07289573 and registered address at Gg107 Metal Box Factory, 30 Great Guildford Street, London, United Kingdom, SE1 0HS (“Freemarket”, “we”, “our” or “us”) and you, the organisation using our services, including any User (as defined below) acting on your behalf (“you” or “your”). Freemarket is authorised and regulated by the Financial Conduct Authority (“FCA”) under the Payment Services Regulations 2017 (“PSR”) (FRN: 585093).

1.3. These Client Terms and Conditions apply where you are not (at the time of entering into these Client Terms and Conditions):

1.3.1. a consumer, meaning an individual acting for purposes other than a trade, business or profession; or

1.3.2. a micro-enterprise, meaning an enterprise engaged in an economic activity in any form which employs fewer than 10 persons and whose annual turnover and/or annual balance sheet total does not exceed €2 million; or

1.3.3. a charity, meaning a body whose annual income is less than £1 million and is: (a) in England and Wales, a charity as defined by section 1(1) of the Charities Act 2011; (b) in Scotland, a charity as defined by section 106 of the Charities and Trustee Investment (Scotland) Act 2005; (c) in Northern Ireland, a charity as defined by section 1(1) of the Charities Act (Northern Ireland) 2008.

If you are a consumer, micro-enterprise or a charity (each as defined above), different terms will apply in our agreement with you and if you believe you have received these Client Terms and Conditions in error, please contact our Client support (see clause 1.10 for details) without delay.

1.4. Freemarket provides a free to access website, made available at www.wearefreemarket.com (“Site”), Freemarket provides the following services (accessed via the Site):

1.4.1. foreign currency international exchange services, as are more fully described in clauses 7.1 and 7.2 below (“Foreign Exchange Services”); and

1.4.2. operation of a payment account (“Account”) and services enabling you to deposit funds into the Account and to make payments from the Account to an account held with a third-party provider (“Payment Services”) (collectively, the “Service”).

All the materials, tools and functionality made available through the Site and the Service are referred to in these Client Terms and Conditions as “Content” and are deemed to form part of the Site and the Service.

1.5. Payment Services provided by us are subject to PSR and are regulated by the FCA. For Payment Services we are required to:

1.5.1. segregate client funds from our own funds in accordance with the PSR on safeguarding client funds; and

1.5.2. maintain a defined level of regulatory capital at all times.

You can learn more about the regulatory environment in the United Kingdom and what it means for your protection on the FCA’s website.

1.6. These Client Terms and Conditions apply to and govern your use of the Site and the Service and form a legally binding agreement between you and Freemarket. By using our Site or Service you are indicating your acceptance of and agreement to these Client Terms and Conditions. It is important that you take the time to read these Client Terms and Conditions carefully. If you do not agree to these Client Terms and Conditions, you must not use any part of the Site or the Service.

1.7. The terms relating to Payment Services in these Client Terms and Conditions constitute terms of a framework contract for the purposes of PSR. You can find a copy of Client Terms and Conditions on our Site. We will provide you with a copy of Client Terms and Conditions by email to the email address provided by you once your application for our Service is accepted by us. We recommend that you download and save a copy of the Client Terms and Conditions for your future reference. You can request to receive a copy of the Client Terms and Conditions at any time throughout the duration of our agreement with you by contacting our Client support (see clause 1.10 for contact details).

1.8. To access the Service, you must make an application to us. Once your application is accepted by Freemarket you may use the Service. Freemarket reserves the right at its sole discretion to decline to provide the Service to you.

1.9. Please note that these Client Terms and Conditions relate to the Site and the Service only, and that if you wish to use other products or services offered by Freemarket, or a Partner (described below), you may be required to enter separate terms and conditions relating to such products and services. The term “Partner” means a third-party business with whom Freemarket has a contractual relationship to assist with the provision of a product or the fulfilment of a service provided by or through Freemarket.

1.10. If you want to contact us, please contact our Client Support team at:

Telephone: +44 (0)20 3393 2709

Email: support@wearefreemarket.com

Weblink: www.wearefreemarket.com/contact-us

Post: Metal Box Factory, 30 Great Guildford Street, London, SE1 0HS

1.11. If we need to contact you or send a notification to you under these Client Terms and Conditions, we will do so by email, telephone, SMS notification or in writing using the contact details you provided us, unless stated otherwise in these Client Terms and Conditions.

1.12. If we need to contact you in the event of suspected or actual fraud or security threats, we will use SMS, telephone, post or another secure procedure to contact you. You may be asked to verify your identity for security purposes;

1.13. These Client Terms and Conditions are in English and the language we use for all of our communications and notifications is English;

1.14. In these Client Terms and Conditions, a “Business Day” means any day that is not a Saturday, Sunday or public holiday in the UK;

1.15. You and Freemarket agree that:

1.15.1. the information requirements set out in the provisions of Part 6 of the PSR do not apply and we will provide to you only such information and in such manner regarding any Payment Services as required under these Client Terms and Conditions;

1.15.2. the obligations set out in regulations 66(1), 67(3), 67(4), 75, 77, 79, 80, 83, 91, 92 and 94 of Part 7 of the PSR do not apply and our obligations to you relating to any Payment Services we provide to you as set out in these Client Terms and Conditions will be only the obligations;

1.15.3. the maximum time period for reporting unauthorised or incorrectly executed payment transactions set out in regulation 74(1) of the PSR is varied by clause 13.1 to the maximum notification period set out in that clause.

2. Using the Site and the Service

2.1. You agree to use the Site and the Service only for lawful purposes and only on compliance with:

2.1.1. all laws and regulations applicable to the Site and the Service,

2.1.2. these Client Terms and Conditions, and

2.1.3. any reasonable instructions that Freemarket may issue relating to the Service or otherwise in relation to the Site and the Service from time to time.

2.2. In offering the Site Freemarket is not making any invitation or solicitation to you or any person to use any information, product or service including the Service and the Content where doing so is prohibited by the law of the country from which you access the Site.

2.3. Parts of the Site and the Service may be subject to legal and/or commercial protections and restrictions which both we and you may be subject to. You agree to comply with any such protections and restrictions, as set out in these Client Terms and Conditions or as otherwise notified by us or a Partner to you. You warrant and represent to us that you are not restricted by any applicable law or regulation (including any international export restrictions) from accessing or using the Site and the Service or any of the Content.

2.4. You must not:

2.4.1. resell, reproduce or otherwise exploit any part of the Site or the Service without the express written permission of Freemarket;

2.4.2. collect or export data from the Site or the Service save as permitted under these Client Terms and Conditions;

2.4.3. other than as permitted in these Client Terms and Conditions copy, modify, adapt, distribute, dissemble, reverse engineer or decompile any aspect of the Site or the Service;

2.4.4. knowingly upload or permit the uploading of any viruses, trojans or other harmful or inappropriate material; or

2.4.5. attempt to circumvent or disable any technological protection measures contained in or used to protect the Site, the Service or Content, or use any Content from which such protection has been illicitly removed, in breach of these Client Terms and Conditions or otherwise.

2.5. We use reasonable endeavours to ensure that Content is current to any date it bears (if any) when published. However, we make no warranty or representation as to the accuracy of any Content and we have no responsibility to update or amend any Content which accordingly may be out of date at any given time.

2.6. We cannot guarantee the availability of our Service to clients:

2.6.1. who are resident or registered in particular countries; or

2.6.2 for receiving payment from or sending payment to certain countries.

We may change or stop the availability of our Service with respect to any particular country at any time without notice to you as required to comply with any applicable law or our policies.

2.7. You will not be able to use your Service to receive or make payments in relation to activities, sectors or industries outside of Freemarket’s risk appetite and/or monies from or to countries which are on Freemarket’s blocked list, as they may be updated from time to time.

3. Registering for the Service

3.1. To access the Service and become a user of the Service (“User”) you will need a FreemarketFX account (“Account”). To open an account you must Sign up. You can do so by using the Sign up form on the Site at www.wearefreemarket.com.

3.2. You agree to provide true, accurate, current and complete information about your organisation (including your directors, beneficial owners and other officers, as relevant) as required by us when you apply for our Service (“Registration Data”) and maintain and promptly update the Registration Data to keep it true, accurate, current and complete throughout the duration of our agreement with you.

3.3. You are responsible and liable for all activities conducted through your Account. When we receive an instruction through the Account from you (including any User acting on your behalf), using your security information (as outlined in clause 5.2) we will deem such instruction as authorised by you.

3.4. To register for our Service, you must:

3.4.1. be an organisation;

3.4.2. be at least 18 years of age (if you are an individual registering on behalf of an organisation);

3.4.3. be capable of entering into legally binding contracts under the law applicable to your country of registration (where you are a Business Client);

3.4.4. only access the Sit and use the Service when in a country that permits access to the Site and use of the Service;

3.4.5. use a valid business email address as your point of contact for registration; and

3.4.6. agree to comply with these Client Terms and Conditions.

3.5 Freemarket will notify you by email using the email address provided by you once your application has been accepted and from the date of such notification you may use the Service.

4. Business Account

4.1. You acknowledge that you are applying for the Service as an organisation (not as an individual to use it in your personal capacity) (“Business Client”) and that any person making the application and/or granted access to the Service will be considered a User. You, the Business Client, agree and warrant that:

4.1.1. you shall comply and shall ensure that each User complies with these Client Terms and Conditions;

4.1.2. each User is authorised to act on your behalf;

4.1.3. you are responsible for all User actions in relation to the Account and/or other Services; we will deem any instruction given by a User as an instruction given by you;

4.1.4. you shall notify us without delay if any of the Users are no longer authorised to have access to any of the Services (including your Account) and you will be liable for any transactions made, fees incurred and use of the Services by a User until the access is revoked.

4.2. You, as a person applying for the Service or otherwise granted access to the Service as a User on behalf of a Business Client, agree, warrant and represent that:

4.2.1. you have and continue to have the full right and authority to bind the Business Client, which you hold yourself out as representing, to comply with these Client Terms and Conditions;

4.2.2. you and the Business Client will have joint and several liability in relation to these Client Terms and Conditions;

4.2.3. you have permission from Business Client to apply in its name;

4.2.4. your permission to access or use any of the Content or the Services shall be automatically and retrospectively revoked if the Business Client challenges the binding nature of these Client Terms and Conditions on the Business Client.

4.2.5. you will immediately notify Freemarket if you leave the employment of the Business Client or your permission to access the Service is otherwise revoked by the Business Client.

4.3. All Users of the Business Client’s Account must have individual User access and comply with these Client Terms and Conditions, including, without limitation, clause 5.

Cash Management Functionality

4.4. Where so requested by you and agreed by Freemarket, your Account can be used to make and receive payments to/from other Freemarket Accounts held by companies within the Business Client’s group (such as its parent and subsidiaries) (“Group Company”). We call this functionality “Cash Management”. You agree that in order to use Cash Management functionality:

4.4.1. each participating Group Company must successfully register for the Service and have a Freemarket Account;

4.4.2. the nominated Group Company (typically, the parent company) (“Managing Company”) shall have the sole authority to manage and give instructions on the Accounts held by other participating Group Company (“Managed Company”).

4.5. Where you are a Managed Company, you agree, warrant and represent that:

4.5.1. you authorise Freemarket to act solely on the instructions of the Managing Company (including any Managing Company’s representatives acting on its behalf) in relation to your Account and that Freemarket shall treat the Managing Company’s instruction on your Account and any resulting transaction as authorised by you;

4.5.2. you consent to the Managing Company (including any Managing Company’s representatives acting on its behalf) providing instructions on your behalf in relation to your Account and for the Managing Company to have access to all transactions, data and other information relating to your Account;

4.5.3. the Managing Company (and any of its representatives granted access to the Service) shall be considered a “User” in relation to your Account; and their access to our Services and your Account shall be governed by and subject to these Terms (including, without limitation, clause 4.1 above);

4.5.4. Freemarket shall not be liable to you and you shall not be entitled to any refund in relation to any transaction executed in accordance with the instructions of the Managing Company.

4.6. Where you are a Managing Company, you agree, warrant and represent that:

4.6.1. you have valid authority and consent from the Managed Company to access and operate the Managed Company’s Freemarket Account, including to instruct transactions on Managed Company’s behalf;

4.6.2. you shall notify us without delay if your authority or permission to have access to any of the Services (including Managed Company’s Account) is revoked; in which case you shall cease all activity in relation to managed Company’s Account and all of your related rights shall be withdrawn.

4.7. Freemarket shall have the right to use the funds in your or any other Group Company’s Accounts to pay any amounts payable by you or any other Group Company to Freemarket.

5. Security

5.1. You must not:

5.1.1. share your Account with any other person;

5.1.2. use or maintain more than one Account, without the explicit approval of Freemarket.

5.2. You and all Users are responsible for keeping any security information such as answers to questions known only to you as the User, usernames, passwords, a PIN, or code generated through a multi-factor authentication security device that may be used (as applicable) to access your Account and/or use the Services, including making an Order and/or Withdrawal (“Security Credentials”), safe, secure and confidential. You and all Users must not give or allow the use of the Security Credentials to any other person (including but not limited to other individuals that you work with if you are accessing and using the Service on behalf of a Business Client) or do anything that may allow any other person to use the Security Credentials (such as writing down passwords or other Security Credentials in a way that someone else could understand or see).

5.3. You and any User must notify us immediately by contacting our Client Support by email or telephone (see clause 1.10 for details) if:

5.3.1. you (or User) know or suspect that any person you have not authorised to access the Account or any other part of the Service has obtained some or all of your Security Credentials or otherwise has unauthorised access to the Account; or

5.3.2 there has been an unauthorised Withdrawal or other transaction on your Account.

6. Cancellation and Termination

6.1. You may terminate your agreement with us under these Client Terms and Conditions by giving us at least 30 days’ notice in writing (see clause 1.10 for our contact details).

6.2. Freemarket may terminate the agreement with you under these Client Terms and Conditions by providing you at least 30 days’ notice.

6.3. If you have not logged into your Account for one calendar year, your Account will become dormant and the information about you will have to be updated and validated in accordance with our policies and procedures in order for your Account to be re-opened.

6.4. Freemarket can suspend or terminate your Account and these Client Terms and Conditions with immediate effect without prior notice to you if:

6.4.1. you are not able to pay your debts when due, stop trading or become insolvent;

6.4.2. we discover that any Registration Data or any other information we hold about you or you have provided us in relation to any transactions is incorrect;

6.4.3. we are not able to confirm the information about you in accordance with our policies and procedures;

6.4.4. you fail to pay any amount due under these Client Terms and Conditions on the due date and remain in default not less than 15 Business Days after being notified in writing to make such payment;

6.4.5. you (or any User) break any important term or repeatedly break any term of these Client Terms and Conditions and (where remediable) fail to remedy it within a period of 15 Business Days after being notified in writing to do so;

6.4.6. we have a reason to believe that you (or any User) have committed or are about to commit crime (including fraud) in relation to the Account;

6.4.7. you (or any User) use the Services in any way that is illegal in any applicable jurisdiction;

6.4.8. we are required to do so to comply with any applicable law or at the request of any regulated body, regulator or a banking partner;

6.4.9. we reasonably believe that continuing to provide the Account and/or other Services to you might expose us to action or censure from any government, regulator or law enforcement agency;

6.4.10. you (or any User) do or omit to do anything which could (actually or potentially) (a) harm our reputation; or (b) harm the reputation of any third party with whom we have a contractual relationship.

6.5. On cancellation or termination of these Client Terms and Conditions by you or by us, your Account will be closed. Once your Account is closed you will no longer be able to use the Services. We will refund the remaining balance on the Account (if any) to an account in your (the Business Client’s) name once all transactions and all relevant fees have been processed. We will use the information you have provided us to try to send the remaining funds back to you. We may ask you to provide satisfactory confirmation of your identity and address before the funds are returned. We may not be able to return the funds to you where we do not have sufficient information.

6.6. You acknowledge that these Client Terms and Conditions will continue to apply for as long you have access to the Service.

6.7. Despite termination of these Client Terms and Conditions, the following clauses will continue in force: clauses 2.3, 2.4, 6.5, 14, 18, 19, 21, 22, 23, 24, 25, 27.

7. Foreign Exchange Services

7.1. At Freemarket, you exchange your currency with other clients on a scheduled basis in scheduled batches (“Scheduled Batch”), and where there is not sufficient liquidity for the currency pair, Freemarket will purchase additional liquidity from a third-party liquidity provider to complete the Scheduled Batch. A Scheduled Batch will complete when all funds have settled. Scheduled Batches occur daily at specified times, typically between 12pm and 1pm on a Business Day.

7.2. You can make an order to exchange currency as part of our Foreign Exchange Services (“Order”) by creating an instruction from your Account to Sell or Buy (each as described below):

A Sell (“Sell Order”) is where you indicate that you wish to convert a fixed amount of a source currency to a target currency. Your Sell Order is then included in the next Scheduled Batch. When the Scheduled Batch completes, the target currency is settled into your account. If you selected a withdrawal as part of the Order, the withdrawal to the beneficiary is enabled for processing from your Account.

A Buy (“Buy Order”) is where you indicate that you wish to buy a fixed amount of a target currency, using a different source currency. Your Buy Order is then included in the next Scheduled Batch. When the Scheduled Batch completes, the target currency is settled into your account. If you selected a withdrawal as part of the Order, the withdrawal to the beneficiary is enabled for processing from your Account.

7.3. As part of the Order creation process you will be notified of the following including, but not limited to:

7.3.1. the information that must be provided by you in order for the Order to be properly initiated or executed which must include the full name of the beneficiary, the beneficiary’s bank account details (if you selected a withdrawal as part of the Order) and the amount and currencies for the Order;

7.3.2. the estimate exchange rate that will be applied to the Order;

7.3.3. the maximum time in which we will execute the Order which will be no longer than 2 Business Days;

7.3.4. the estimated charges for currency conversion and such other costs or charges as Freemarket may reasonably be required to incur in order to fulfil your Order; and

7.3.5. the estimated total amount of the credit transfer by way of Withdrawal (as defined below) in the currency of the beneficiary’s account, including any transaction fees and currency conversion charges and the estimated amount to be transferred to the beneficiary in the currency of the beneficiary’s account.

7.4. Following notification from you of the above information you will need to have provided Freemarket with sufficient funds in order for Freemarket to proceed with your Order.

7.5. Following our placement of the Order, we will confirm to you:

7.5.1. the Order reference and confirmation of the beneficiary details;

7.5.2. the currencies and amounts of the Order;

7.5.3. the charges relating to such Order;

7.5.4. the exchange rate used and the amount of the Order after the currency conversion; and

7.5.5. the date on which we received the Order.

7.6. Order Instructions from you must be received, and funds allocated to your Account in order to be included in the next Scheduled Batch.

7.7. Freemarket will carry out “Know Your Client” and anti-money laundering checks in relation to each Order. Consequently, these checks may increase the time for processing your Order. Freemarket will not be responsible for any delays as a result of carrying out such checks.

7.8. Orders may be cancelled by you within your Account any time before the Scheduled Batch has started processing.

8. Order Process

8.1. The process for placing an Order shall be as set out on the Site and as amended by us from time to time.

8.2. You acknowledge that no Order will be processed until Freemarket has received sufficient cleared funds from you in your Account.

8.3. If Freemarket is unable to accept an Order request for whatever reason, including an error in displaying the correct price on the Service, Freemarket will inform you of this at the time you make the Order.

9. Order Fulfilment

9.1. You acknowledge and accept Freemarket does not have any control over the activities of its Partners, the global banking payment systems or your financial institution. Therefore, Freemarket cannot determine or influence:

9.1.1. when you or your beneficiary will receive cleared funds following an Order; and

9.1.2. the charges levied by a Partner and/or your financial institution, and/or a financial institution used by Freemarket and its partners to fulfil any Order

9.2. Save to the extent explicitly set out otherwise in these Client Terms and Conditions, Freemarket accepts no liability or responsibility for any delay in transmission or receipt of the funds or charges levied by a Partner and/or your financial institution and/or a financial institution used by Freemarket and/or its Partners.

10. Your Account

10.1. Your Account is a payment account which can be used to:

10.1.1. deposit funds into your Account by electronic bank transfer (for the purpose of using the funds for placing an Order with Freemarket); and

10.1.2. to make payments out from your Account by electronic transfer to an account held with a third party provider (“Withdrawal”), as part of fulfilment of the Order or otherwise as instructed by you in accordance with the terms set out in these Client Terms and Conditions.

10.2. Where so requested by you and agreed by Freemarket, your Account can also be used to receive payments into or make payments out from your Account by electronic transfer another client’s Freemarket Account. These types of payments are limited to transfers between the approved Freemarket client Accounts and shall be governed by and subject to these Terms. Accordingly, the term “Bank Transfer” (see clause 11.3) shall include transfers into your Account from another client’s Freemarket account and the term “Withdrawal” (see clause 10.1.2 above) shall include payments from your Account to another client’s Freemarket Account.

10.3. You confirm all monies deposited by you in your Account are legally and beneficially owned by you as the Business Client and are not, and will not be while held in your Account, subject to any charge lien or other encumbrance of any kind.

10.4. You shall not be entitled to any interest on monies held in your Account. The monies held in your Account are not subject to the Financial Services Compensation Scheme.

10.5. Freemarket will not accept a deposit, nor any instruction relating to the transfer of monies until your Account is opened.

10.6. Monies deposited by you in your Account shall remain your property. You agree that all monies deposited in your Account are solely for the use of placing Orders with Freemarket. You acknowledge and agree Freemarket may deduct sums from or withhold any deposit or held monies by way of payment towards the fulfilment of any Order, foreign exchange transaction or as may be required by law, regulatory body or by Freemarket in respect of any transfer or charges owed to Freemarket.

10.7. If there are funds remaining in your Account following: (a) an Order you have made, (b) a foreign exchange transaction; or (c) receipt of an international payment from a third party, for a period of 30 days and such funds are not linked to another Order you wish to make, then we may return such funds to a bank account nominated by you. Such bank account must be held in your (the Business Client’s) name. You will be charged a custody fee calculated on the average daily balance in your Account in a given month as set out here: in Clause 29 Fees.

10.8. Financial and other limits may apply to the instructions on your Account (for example, the maximum balance that may be held on your Account, the value of an individual Withdrawal or an aggregate number or value of Withdrawals in a particular time period). We will tell you what those limits are and may change them from time to time. To manage our risk, particularly with respect to money laundering, fraud or security concerns, we also apply internal controls, including limits, to certain types of payments. We change these as necessary but for security purposes, we do not disclose them. We may refuse your instructions, including Withdrawals, if they breach any such limits.

11. Depositing Funds into Account

11.1. To deposit funds with Freemarket, you must login to your Account and follow the instructions to deposit funds and/or to create an exchange instruction. You will be provided full bank details to instruct a bank transfer from the remitting bank to Freemarket (“Deposit Instructions”).

11.2. You must use the Deposit Instructions accordingly based on whether you are making a domestic or international deposit. The Deposit Instructions will include a unique transaction reference (“Payment Reference”) which must be used to deposit funds. Failure to use the Payment Reference may result in funds being returned to the remitting account.

11.3. Monies can only be transferred to your Account via electronic bank transfer (“Bank Transfer”). Freemarketdoes not accept cash, credit or debit card payments. Bank Transfers to deposit funds with Freemarket is not part of our Services. Bank Transfers to deposit funds with Freemarket are services provided by third party provider of the remitting account. We cannot guarantee the availability of any particular Bank Transfer method and may change or stop accepting funds by a particular Bank Transfer method at any time without notice to you.

11.4. We will credit your Account when we receive the funds by a Bank Transfer, which could be up to 4 Business Days after the Bank Transfer was instructed, depending on how and where it was sent from. You can find out when the funds received by Bank Transfer will be made available to you by contacting us (see clause 1.10 for our contact details). Freemarket will carry out the “Know Your Client” and anti-money laundering checks on receipt of funds. We may at any time ask you to provide information to verify payments and the source of funds for any Bank Transfer into your Account.

11.5. An incoming Bank Transfer may not be credited to your Account if:

11.5.1. doing so would breach any applicable limit in relation to your Account;

11.5.2. the Account is inactive, dormant, blocked or terminated;

11.5.3. you have failed to provide information that we have requested in relation to the Bank Transfer;

11.5.4. the sender has provided incorrect/invalid Account details for your Account or Payment Reference;

11.5.5. we suspect the payment is fraudulent or unauthorised; or

11.5.6. it relates to a transaction which is outside of Freemarket’s risk appetite and/or monies being deposited from a country which is on Freemarket’s block list (see clause 2.7 for more details).

11.6. If we are unable to credit your Account for any of the reasons in clause 11.5, the incoming Bank Transfer may be sent back to the sender without a prior notification to you.

11.7. Fees may apply to process deposits to your Account. If fees are to be charged these will be agreed with you in advance.

11.8. Funds received may be subject to reversal. You acknowledge that the funds received in your Account (“Received Amount”) may be subject to reversal and you agree that we may deduct the Received Amount from your Account if it was reversed by the person who paid you the Received Amount or any relevant payment services provider.

12. Authorising Withdrawals from your Account

12.1. A Withdrawal from your Account will be deemed to be authorised by you when you or the User, either as part of making an Order or otherwise, give us an instruction having logged into your Account accessible via the Site.

12.2. You may be required to provide appropriate Security Credentials depending on the method used to give us instructions, which we may need to verify over the telephone.

12.3. When you instruct us to make a Withdrawal, you must provide us with the correct beneficiary details and a reference for the payment and any other information we ask for. For Withdrawals to UK accounts, this means the beneficiary’s name, account number and sort code and payment reference. For Withdrawals to accounts outside the UK, we may need additional information, such as an IBAN, or the beneficiary’s full bank account details depending on destination. We may also ask you to provide such additional information and evidence as we may reasonably require, including but not limited to details of the beneficiary and the reason for payment. If you provide us with incorrect or incomplete information or refuse to provide information or evidence, we may refuse to execute the Withdrawal, the funds could be lost and irrecoverable or there could be a delay in the beneficiary receiving the payment.

12.4. We will execute the Withdrawal on the same Business Day we received your instruction, except where we receive the instruction not on a Business Day or after 4:00PM on a Business Day, in which case your instruction will be deemed to be received on the following Business Day.

12.5. Once we receive your instruction to make a Withdrawal (as part of the Order or otherwise), you cannot revoke it, except where we have agreed to execute the Withdrawal in the future date (for example, when your Order has been completed), provided that you give us notice of cancellation of the Withdrawal no later than the end of a Business Day before the Withdrawal is due to be executed. You can provide your notice of cancellation by contacting our Client Support (see clause 1.10 for details).

12.6. Where we execute the Withdrawal from your Account to another account in the UK, the payment will be credited to the beneficiary’s account no later than the end of the next Business Day, and usually quicker, except if the transfer involves a currency other than sterling. When there has been a currency conversion involved, then a longer period may apply, as set out in the table below. Where we execute the Withdrawal from your Account to another account outside the UK, such payment can take longer, depending on the type of payment and the recipient country. The beneficiary’s account will be credited within the following time limits:

| Withdrawals within and outside the U.K. | Delivery to beneficiary’s account |

|---|---|

| Payment in euros to an account in the UK | No later than the end of the next Business Day after we execute your Withdrawal instruction. |

| Payment in euros to an account in the EEA | No later than the end of the next Business Day after we execute your Withdrawal instruction. |

| All other payments in the EEA currencies to accounts in the EEA | No later than four Business Days after we execute your Withdrawal instruction. |

| Payments to accounts outside the EEA | Varies, depending on the currency or country you’re sending the payment to. |

| Payments in non-EEA currencies | Varies, depending on the currency or country you’re sending the payment to. |

12.7. We may at any time suspend or restrict your use of the Account or refuse to execute your instructions if:

12.7.1. we are concerned about the security of or access to your Account and/or Security Credentials;

12.7.2 we suspect the Account is being used in an unauthorised, illegal or fraudulent manner;

12.7.3. the instruction is unclear, illegible, incorrect or incomplete or you have failed to provide us the information and/or evidence we requested in relation to a transaction;

12.7.4. executing your instruction would cause a breach of any applicable limit in relation to your Account;

12.7.5. you (or the User) have failed to use the authentication method and/or Security Credentials required;

12.7.6. there are insufficient cleared funds to cover the amount of the Order and/or Withdrawal and any applicable fees;

12.7.7. we have reasonable grounds to believe that you (or the User) are not complying with these Client Terms and Conditions; or

12.7.8. we are required to do so to comply with the law.

12.8. Where we refuse to execute your instruction, or suspend, restrict or cancel your Account, we will notify you as soon as possible provided it would not be unlawful for us to do so. If possible, we provide the reasons for refusal to execute the instruction and/or suspending use of your Account and where those reasons relate to factual matters, the procedure for rectifying any factual errors that led to such refusal or suspension.

12.9. All Withdrawals from your Account are subject to our compliance, anti-money laundering checks and risk checks. This may result in us holding, delaying or refusing to execute a Withdrawal. In such case we will, where possible, notify you of the reasons for such refusal or delay.

13. Unauthorised or Incorrectly executed Withdrawals

13.1. In the event we execute a Withdrawal incorrectly or a Withdrawal which you have not authorised, you must, on becoming aware of such incorrectly executed or unauthorised Withdrawal , notify us without delay by email or telephone (see details in clause 1.10). In any case, you must inform us of the unauthorised or incorrectly executed Withdrawal or Bank Transfer within 30 days after the debit date. On receipt of your notification, we will review your instructions, investigate, trace the relevant payment, and notify you of our findings (to the extent we are permitted to do so by law).

13.2. If we are responsible for crediting a Bank Transfer into your Account later than it should have been, then we will credit your Account with the amount of the Bank Transfer without undue delay after we complete our investigation, and provided that we have actually received the Bank Transfer in cleared funds.

13.3. If we are responsible for executing a Withdrawal incorrectly then we will make reasonable efforts to trace the payment and recover the amount if you ask us, and to the extent we recover the amount of the incorrectly executed Withdrawal, we will refund it to you without undue delay. We will not be liable for any incorrectly executed Withdrawal where:

13.3.1. the instruction you gave us for the Withdrawal was not correct;

13.3.2. we can show that the Withdrawal was actually received in the Beneficiary’s account (in which case the beneficiary’s payment service provider is liable);

13.3.3. we were not able to recover the incorrectly executed Withdrawal.

13.4. If after we have given you a refund our investigations of a disputed Withdrawal subsequently discover that it was in fact genuine and authorised by you directly or indirectly, or that you are otherwise liable for the Withdrawal (see clause 13.6 below) , we will deduct the amount of the disputed Withdrawal (together with any fees, charges and interest paid to you) from your Account balance and we reserve the right to recover the value of any Withdrawal and any fees, charges and interest that was refunded to you by any other legal means.

13.5. You will be liable for all losses incurred in respect of an unauthorised or incorrectly executed Withdrawal and will not be entitled to a refund if:

13.5.1. the Withdrawal was made and/or authorised by you or User (directly or indirectly). If you provided us with incorrect details for executing the Withdrawal, you may ask us to assist you in recovering the money. In such circumstance, we cannot guarantee such efforts will be successful and we reserve the right to charge you a fee of £35 to cover our reasonable costs for doing this; or

13.5.2. the Withdrawal was instructed using Security Credentials issued to you (or User).

13.5.3. you or User have acted fraudulently or have intentionally or negligently failed to keep your Security Credentials safe and secure or have otherwise failed to comply with these Client Terms and Conditions; or

13.5.4. you have failed to notify us in accordance with clause 13.1.

In any other case, where you wish to claim a refund with respect to a Withdrawal and/or Bank Transfer, it will be up to you to satisfy us that a Withdrawal and/or Bank Transfer (as the case may be) was not executed, executed late or not authorised by you or User before we provide you with a refund.

13.6. If a Bank Transfer is paid into your Account in error, we will, where possible, immediately send the funds back to the payer’s account or payment service provider. In such circumstance you agree to return the funds to us and provide such assistance that we require in recovering the amount from you. If we cannot recover the funds, we are required to provide sufficient details about you and the incorrect payment to the payment service provider that sent the payment to enable them to recover the funds.

14. Know Your Client and Anti-Money Laundering

14.1. Freemarket is required to apply procedures aimed at the prevention and detection of financial crimes. Freemarket may use the services of a Partner to establish your identity as part of the registration process for an Account, as part of processing an Order or Withdrawal and as required for the purpose of ongoing routine monitoring, including the identity of payees.

14.2. We monitor all transactions and if we believe funds are derived from financial crime, we may report such transactions to regulatory authorities in the United Kingdom, in the country of the origin of the funds and the destination. Where a report of potential financial crime is made, Freemarket accepts no liability for any delay in transmission of or confiscation of the funds. Freemarket reserves the right to provide a copy of the information you provide as part of the Account opening process to regulatory authorities in the United Kingdom, in the country of the origin of the funds and the destination.

14.3 You represent and warrant that all monies transferred into your Account are in no way connected to any unlawful or illegal activity. Any breach of this clause shall be deemed a material breach of these Client Terms and Conditions and Freemarket reserves the right to immediately and without notice suspend your access to the Services or terminate the Client Terms and Conditions and/or close your Account in such circumstances.

14.4. Freemarket reserves the right at all times, and with no notice, to refuse to process any Order in its sole discretion at any time during the Order process.

15. Account Statements

15.1. We will make the following information available to you through your Online Account accessible via the Site: (a) a reference enabling you to identify each Deposit or Withdrawal and the payer or the payee (where applicable); (b) the amount of each Bank Transfer or Withdrawal; (c) the currency in which your Account is debited; (d) the amount of any charges including their break down, where applicable; (e) the exchange rate used in the Bank Transfer or Withdrawal by us and the amount of the Bank Transfer or the Withdrawal after the currency conversion, where applicable; and (d) the value date or the Bank Transfer or Withdrawal (as applicable). You can download or print your statements containing the same information at any time from your Online Account Centre. You should check your Account statement regularly and download and print a copy for your records at least monthly as you may not be able to have access to your statements after your Account is closed. Unless we have agreed with you or are required by law otherwise, we will only make this transaction information available on the Online Account for 12 months. If there are no Bank Transfers to or Withdrawals from the Account for more than a month then we will not provide you with a statement.

16. Third Party Access to your Account

16.1. You may instruct providers of Account Information Services to access information on your Account or providers of Payment Initiation Services to initiate certain payments from your Account, provided such provider is authorised by the FCA in the UK or another European regulator to provide the relevant service. “Account Information Service” or “AIS” is an online service which accesses one or more of your payment accounts to provide a consolidated view of such accounts. “Payment Initiation Service” or “PIS” is an online service which accesses your account to initiate the transfer of funds on your behalf. Some providers of AIS or PIS may (with your permission) choose to access your Account without identifying themselves to us and to use your Security Credentials. We will treat any instruction from such providers as if it was from you. You should always consider the implications of sharing your Security Credentials and personal information.

16.2. We may deny the provider of AIS or PIS access to your Account if we are concerned about unauthorised or fraudulent access by that provider setting out the reason for such denial. Before doing so, we will tell you that we intend to deny access and give our reasons for doing so, unless it is not reasonably practicable, in which case we will immediately inform you afterwards. In either case, we will tell you in the manner in which we consider most appropriate in the circumstances. We will not tell you if, doing so would compromise our security measures or would otherwise be unlawful.

16.3. If you have provided consent to a provider of AIS or PIS to access to your Account to enable them to provide those services to you, you consent to us sharing your information with the Third Party Provider (TPP) as is reasonably required for them to provide the relevant services to you. You must let us know if you withdraw this permission and we recommend you let the relevant provider of the AIS or PIS know. On notification from you, we will not provide such provider of AIS or PIS access to your Account.

17. Changes to these Client Terms and Conditions

17.1. Reasons why we may change these Client Terms and Conditions may include, without limitation changes:

17.1.2. in market conditions or operating costs that affect our business;

17.1.3. in technology;

17.1.4. in payment methods;

17.1.5. in relevant laws or regulation;

17.1.6. to make them clearer or more favourable to you; or

17.1.7. to our systems.

17.2. We may change the terms in these Client Terms and Conditions by giving you at least 30 days’ prior notice.

18. Copyright and other intellectual property

18.1. Except as expressly set out otherwise in these Client Terms and Conditions, Freemarket and its licensors own and retain all intellectual property rights in and to the Site, Content and the Service.

18.2. For as long as these Client Terms and Conditions remain in force between you and us, Freemarket hereby grants to you a limited, non-transferable, non-sublicensable, worldwide licence to access and use the Site, Content and the Service on the terms set out in these Client Terms and Conditions.

18.3. In relation to each separate item of your Account history contained within the Content (“User Content”) and subject to the terms of these Client Terms and Conditions, Freemarket hereby grants you a personal, revocable, non-exclusive, non-sublicensable and royalty-free license to view, use and (where technically permitted) save one copy of such User Content for internal training and internal information purposes only. Any use of the User Content outside the scope of the license granted under this clause 18.3 shall, without prejudice to any other rights or remedies available to Freemarket, constitute a material breach of these Client Terms and Conditions.

18.4. If you breach your obligations under the Client Terms and Conditions, close your Account or if these Client Terms and Conditions terminate (for any reason), all licenses granted to you under these Client Terms and Conditions will automatically terminate.

19. Third party terms

19.1. In respect of any service or content provided through the Service by a Partner, such content or service will be provided in accordance with such Partner’s applicable terms and conditions of service (or as otherwise notified to you by Freemarket from time to time) (“Partner Terms”). These Partner Terms will apply to you in addition to these Client Terms and Conditions.

19.2. If this Site contains links to websites provided by third parties those links are made available:

19.2.1. for your convenience only;

19.2.2. with your acknowledgement that Freemarket does not control such third-party websites or the content on them;

19.2.3. without warranty or representation from Freemarket as to the content or accuracy of the information on them; and

19.2.4. without liability to Freemarket for the content or products offered through them.

20. Service Availability

20.1. Freemarket does not guarantee that the Service will be available at all times and there will be times when the Service will be interrupted for maintenance, upgrades or repairs or due to failure of services or equipment. Freemarket reserves the right to modify, suspend or discontinue all or part of the Service at any time with or without notice.

20.2. You agree that Freemarket is not liable or responsible to you for any delay, interruption, unavailability or discontinuance of the Service arising due to circumstances beyond Freemarket’s control and provided that such delay, interruption, unavailability or discontinuance is not attributable to gross negligence or wilful misconduct of Freemarket.

21. Limitation of Liability

21.1. You agree that, to the maximum extent permitted by law, Freemarket will not be liable to you (or any third party) under contract, tort (including negligence) or otherwise for any of the following losses you incur:

21.1.1. loss of profit, loss of revenue, loss of use, loss of contracts, loss of opportunity, loss of business, loss of anticipated savings and loss of data, in each case whether direct or indirect; or

21.1.2. indirect, incidental, consequential, special, exemplary and punitive losses, (together shall be referred to as the “Losses”).

21.2. Freemarket will not be liable to you for Losses arising as a result of:

21.2.1. any failure of Freemarket’s technical or computer systems which is not attributable to gross negligence or wilful misconduct of Freemarket, or which arises due to circumstances beyond Freemarket’s control.

21.2.2. any fraudulent spending or any other unauthorised use of your Account, unless such Losses occurred as a result of our negligence; or

21.2.3. any change in foreign currency rates which occur.

Except as required by applicable law, your sole remedy for dissatisfaction with the Service is to stop using the Service.

21.3. Freemarket does not take any responsibility for any consequences of you using the Service or any other service provided by us to trade (or to refrain from trading) in a live environment in any marketplace or transactional facility (whether provided by Freemarket or by any third party).

21.4. Subject to clauses 21.121.221.5, 21.2 and 21.5 Freemarket’s total liability to you in respect of all losses arising under or in connection with the Site and the Service, whether in contract, tort, breach of statutory duty or otherwise shall in no circumstances exceed the greater of: (a) £500,000; or (b) the commissions earned by Freemarket from the Account in the twelve (12) months preceding the date you suffered the loss.

21.5. Nothing in these Client Terms and Conditions limits or excludes a party’s liability for:

21.5.1. death or personal injury caused by that party’s negligence;

21.5.2. fraud or fraudulent misrepresentations; or

21.5.3. any other limitation or exclusion not permitted under applicable law.

21.6. Freemarket shall not be liable for any virus, trojan or other harmful or inappropriate material that may affect your computer equipment, computer programs or other materials as a result of use of the Service.

22. Indemnity

22.1. You agree, at your own expense, to indemnify, defend, and hold harmless Freemarket and the Partners against any and all losses suffered or incurred by Freemarket or the Partner in relation to your or User’s use of or access to the Service, or as a consequence of you or User not complying with any term of these Client Terms and Conditions or any unauthorised party using your Account.

22.2. Where you are a Managing Company, you agree to indemnify Freemarket against any and all actions, claims, costs, damages, demands, expenses, liabilities, losses and proceedings Freemarket directly or indirectly incurs or which are brought against Freemarket in relation to (a) any instruction given by you (including any of your representatives acting on your behalf) or transaction carried our pursuant to such instruction in relation to the Managed Company’s Account; (b) any fraudulent or negligent actions or omissions of you (including any of your representatives acting on your behalf) in relation to Managed Company’s Account.

General conditions

23. Exclusion of Warranties

23.1. While reasonable efforts have been made to ensure the accuracy, currency and reliability of the Content provided on the Site and through the Service, you acknowledge and agree that all Content and the Service is provided “as is” and we cannot guarantee the completeness, accuracy, timeliness or results obtained by you through using the Site and the Services.

23.2. Other than as expressly set out in these Client Terms and Conditions, we do not give any warranty of any kind, express or implied, on behalf of us or our suppliers or our Partners in relation to the Site, the Service or anything else provided through or under these Client Terms and Conditions, including warranties as to performance, merchantability or fitness for a particular purpose You assume sole responsibility and risk for your use of any aspect of the Site and the Service.

23.3. Time shall not be of the essence and Freemarket accepts no responsibility for any delay in onward payment which is attributable to your use of the Site and the Service.

23.4. Freemarket shall bear no responsibility to you, or any third party, as a result of any circumstances arising that are beyond our reasonable control, including riot, civil unrest, war, act of terrorism, threat or perceived threat of act of terrorism, natural disaster including but not limited to an earthquake or extraordinary storm, lock out or other industrial disputes or any act of any government, legal authority or regulator, or changes in applicable law, public internet failure, to the extent that such circumstance materially affects Freemarket’s ability to perform its obligations under these Client Terms and Conditions. On the happening of such circumstance, then we will immediately notify you of the extent to which we are prevented from performing our obligations. We will use reasonable efforts to minimize the effect of the circumstances arising on the Service.

23.5. You expressly acknowledge and agree that the restrictions on the liability of Free market under these Client Terms and Conditions (including as to the disclaiming of any warranties) are reasonable in the context of the fees being charged by Freemarket for the use of the Service.

24. Complaints

24.1. If you are not satisfied with our Service you may make a complaint in writing (email or post) to us at Client Support setting out the nature and scope of your complaint. On receipt of your complaint we will investigate it with the aim of resolving it promptly. We may require you to provide additional information to assist us in our investigations. In most cases we will provide a full response to your complaint within 15 Business Days after the date we receive your complaint. In exceptional circumstances, if a full reply cannot be given within this timeframe we will send you a holding reply within 15 Business Days indicating the reasons for the delay in providing a full reply to your complaint and specifying the deadline by which you will receive our final response, being no later than 35 Business Days from the date of your initial complaint.

24.2. If you do not receive our response (whether holding or final) within the times specified in clause 24.1 above or you are unhappy with our final response you may be eligible to refer your complaint to the Financial Ombudsman Service (“FOS”) at Exchange Tower, Harbour Exchange Square, London E14 9SR; Telephone: 0800 023 4567; website: “www.financial-ombudsman.org.uk”, free of charge, but you must do so as soon as possible and no later than within 6 months of the date of our final response to your complaint.

25. Severability

25.1. If any clause (or part of a clause) in the Client Terms and Conditions is determined to be invalid, illegal or unenforceable by any court or administrative body of competent jurisdiction, the parties agree, it shall be deemed deleted, but that shall not affect the validity and enforceability of the rest of the Client Terms and Conditions. If any clause or part of a clause is deemed deleted the parties shall negotiate in good faith to agree a replacement provision that to the greatest extent possible, achieves the intended commercial result of the original clause.

26. Waiver

26.1. No failure or delay by a party to exercise any right or remedy under these Client Terms and Conditions or by law shall constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict the further exercise of that or any other right or remedy.

27. Governing Law and Jurisdiction

27.1. These Client Terms and Conditions are governed by and construed in accordance with the laws of England and Wales.

27.2. Each party irrevocably agrees, for the sole benefit of Freemarket, that subject as provided below, the courts of England and Wales shall have exclusive jurisdiction over any dispute or claim (including non-contractual disputes or claims) arising out of or in connection with this Agreement or its subject matter or formation. Nothing in this clause shall limit the right of Freemarket to take proceedings against you in any other court of competent jurisdiction, nor shall the taking of proceedings in any one or more jurisdictions preclude the taking of proceedings in any other jurisdictions, whether concurrently or not, to the extent permitted by law of such other jurisdiction.

28. Entire Agreement

28.1. These Client Terms and Conditions represent the entire understanding between you and us regarding your use of the Site and the Service. Unless expressly stated otherwise, these Client Terms and Conditions supersede any previous agreements between you and us including previous versions of these Client Terms and Conditions and the Privacy Policy. You acknowledge that you have not relied on any statement, promise or representation made or given by or on behalf of Freemarket which is not set out in the Client Terms and Conditions.

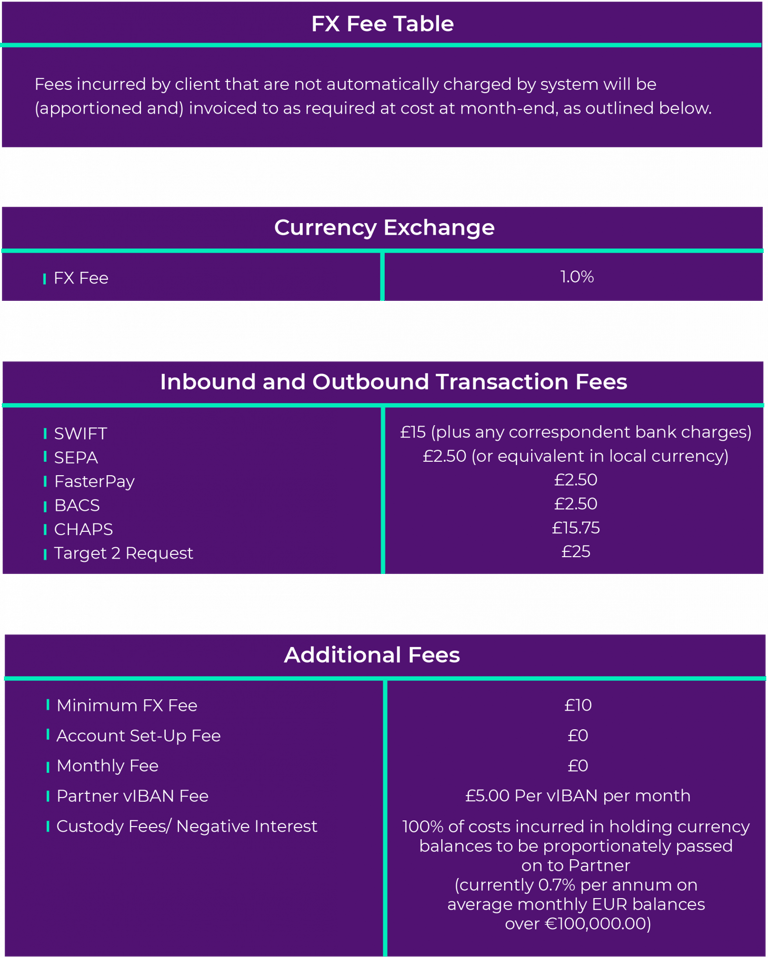

29. Fees

All historic commercial agreements prior to 22nd July 2020 will be honoured by Freemarket. In addition, Freemarket reserve the right to adjust the commercials on a case-by-case basis before entering into a new commercial relationship.

All fees are quoted excluding VAT. Freemarket’s services are currently treated as exempt supplies, but if this changes, we will need to charge VAT as appropriate

30. Privacy Policy

30.1. Any personal information you provide or we collect in connection with your use of the Services will be collected and used in accordance with the Privacy Policy as amended from time to time, which is available here.

31. Cookies

31.1. Freemarket uses certain cookies in the Service. Please see our Cookie Policy for a description of what cookies are, how we use them and how you can opt of them. However, please be aware that if you choose not to accept cookies you may find that certain parts of the Site and the Service will not function properly or that your user experience may be affected.